ev charger tax credit form

So I found out my circuit panel is full in the house i just purchased. The federal government offers a tax credit for EV charger hardware and EV charger installation costs.

What Are The Different Levels Of Electric Vehicle Charging Forbes Wheels

Also use Form 8936 to figure your credit for certain qualified two- or three-wheeled plug-in electric vehicles.

. Use Form 8936 to figure your credit for qualified plug-in electric drive motor vehicles you placed in service during your tax year. Up to 1000 Back for Home Charging. Under the Biden administration there are high hopes that these EV charging tax credits will continue and even expand.

However I cant find any evidence of this being valid past 123121. Install costs can account for the majority of the total cost of installing EV charging especially for commercial installations. Feel free to contact us if you have any additional questions.

All ClipperCreek charging stations qualify for the federal tax credit. However the draft is out and it looks similar to the old form. Ad So geht Flottenelektrifizierung aus einer Hand.

This tax credit helps subsidize the installation costs of residential charging and commercial charging stations. The federal tax credit covers 30 of an EV charging station necessary equipment and installation costs. However if a taxpayer relocated.

It covers 30 of the costs with a maximum 1000 credit for residents and 30000 federal tax credit for commercial installs. However the credit is worth up to 7500 depending on the size of the battery. IRS Form 8911 has not been finalized yet for the EV Charger credit.

The Federal EV Charger Tax Credit program offers a rebate of 1000 per site. For more information about claiming the credit see the Internal Revenue Service IRS Plug-In Electric Vehicle Credit website and IRS Form 8936 which is available on the IRS Forms and Publications website. You can receive a tax credit of up to 30 of your commercial electric vehicle supply equipment infrastructure and installation cost or up to 30000.

EV charging stations purchased in 2018 through the end of 2020 are now eligible for a 30 tax credit for purchase and installation costs up to 1000 dollars for residential installations and up to 30000 for commercial installations. All-electric and plug-in hybrid vehicles bought new in or after 2010 may be eligible for a 7500 federal income tax credit. This importantly covers both components on charging costs.

Unlike some other tax credits this program covers both EV charger hardware AND installation costs. The incentive can be a large percentage of the charger and installation costs. Just buy and install by December 31 2021 then claim the credit on your federal tax return.

Learn more about the Federal Tax Credit. Egal ob E-Transformation oder Smart Charging wir beraten Sie kostenlos. In other words costs of 100000 per location are eligible for the credit potentially yielding a combined credit far in excess of 30000 for taxpayers who installed commercial chargers at multiple locations.

State and municipal tax breaks may also be available. The US Federal Tax Credit gives individuals 30 off a Home Electric Vehicle charging station plus installation costs. The Federal Goverment has a tax credit for installing residential EV chargers.

Another aspect of tax credits for EV charging and other sustainability measures is that often the amount of rebate offered is dependent upon a time limit or by how many rebates have been used. The credit attributable to depreciable property refueling property used for business or investment purposes is treated as a general business credit. Egal ob E-Transformation oder Smart Charging wir beraten Sie kostenlos.

2021 is the last year to claim a tax credit on the installation of your plug-in electric vehicle. And its retroactive so you can still apply for installs made as early as 2017. If your utility company.

The credit is the smaller of 30 or 1000. After the base 2500 the tax credit adds 417 for a 5. The credit is for 10 of the cost of the qualified vehicle up to 2500.

For residential installations the IRS caps the tax credit at 1000. Ad So geht Flottenelektrifizierung aus einer Hand. The rebate program covers Level 1 Level 2 and Level 3 chargers.

Youll need to know your tax liability to calculate the credit. Must be purchased and installed by December 31 2021 and claim the credit on your federal tax return. Essentially any PHEV that meets the minimum requirements as outlined above qualifies for at least 2500.

That could mean up to 30 savings and if your business spends 50000 on EV charger installation you could get up to 15000 back in federal funds. Similar forms or applications are required for state and local programs. Current Revision Form 8936 PDF Instructions for Form 8936 Print Version PDF Recent Developments.

The federal government offers a tax credit for EV charging stations known as the Alternative Fuel Infrastructure Tax Credit for equipment and installation costs. 30 tax credit up to 1000 for residential and 30000 for commercial. For the federal tax credit youll need to submit IRS Form 8911 when you file your business taxes.

Nachhaltig rentabel datenbasiert. Since installation costs are significant for EV chargers this rule allows you to get the most tax credit. You use form 8911 to apply for the Federal.

Federal EV Charger Incentives The federal government offers a tax credit for EV charger hardware and EV charger installation costs. Does the federal tax credit also cover 30 of everything including getting. The incentive may cover up to 30 of the project cost.

Log In Sign Up. Federal EV Charging Tax Credit. Nachhaltig rentabel datenbasiert.

The federal government offers tax incentives for businesses to install Level two and three EV chargers. For residential property 1000 is closer to an absolute cap because a taxpayer can have only one primary residence. Tax Credits for Ev charger install.

This video covers how to complete IRS Form 8911The federa. To cut a long story short i purchased my ChargePoint Home Flex charger. Grab IRS form 8911 or use our handy guide to get your credit.

Federal tax credit gives individuals 30 back on a ChargePoint Home Flex EV charger and installation costs up to 1000. Press J to jump to the feed. In order to take the credit for 2019 it appears it.

Use this form to figure your credit for alternative fuel vehicle refueling property you placed in. This federal EV infrastructure tax credit will offset up to 30 of the total costs of purchase and installation of EV equipment up to a maximum of 30000 for commercial property and 1000 for a primary residence. Tax credits are available for EV charger hardware and installation costs.

Form 8911 is used to figure a credit for an alternative fuel vehicle refueling property placed in service during the tax year. The value of the EV tax credit youre eligible for depends on the cars battery size. Because the point of tax credits and rebates is to help aid in adoption they may decrease or end over time or lessen as more units are sold.

How do I apply for a tax credit for installing electric-vehicle charging stations. Complete your full tax return then fill in form 8911. Press question mark to learn the rest of the keyboard shortcuts.

How Much Is the EV Tax Credit Worth. The amount of the credit will vary depending on the capacity of the battery used to power the car. This form walks you through reporting your expenses for the project and calculating your credit.

However the draft is out and it looks similar to the old form. Were EV charging pros not CPAs so we recommend getting advice from your own tax professional. It covers 30 of the costs with a maximum 1000 credit for residents and 30000 federal tax credit for commercial installs.

Tip Keep in mind that you need to have a tax liability in other words you need to owe taxes in order to claim a tax credit.

Tax Credit For Electric Vehicle Chargers Enel X

Commercial Ev Charging Incentives In 2022 Revision Energy

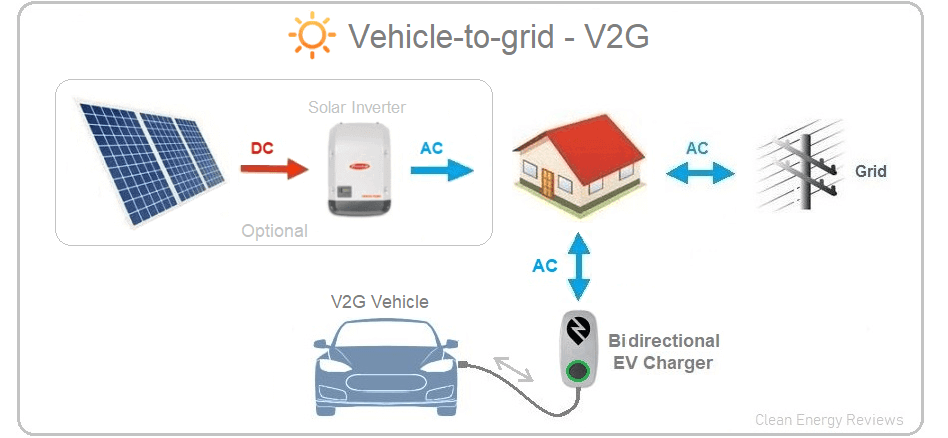

Bidirectional Chargers Explained V2g Vs V2h Vs V2l Clean Energy Reviews

Electric Vehicle Charging Stations Present Opportunity For Electricians Nip Group

Guide To Home Ev Charging Incentives In The United States Evolve

Can I Get A Tax Credit For An Ev Charger In New York Roy S Roy S Plumbing Heating Cooling

4 Things You Need To Know About The Ev Charging Tax Credit The Environmental Center

Charge Your Ev Up To 7x Faster With A Level 2 Home Ev Charger

About Electric Vehicle Charging Efficiency Maine

Ev Charging Tacoma Public Utilities

Residential Charging Station Tax Credit Evocharge

Blink Ev Chargers On Industrial Design Served Electronics Design Electric Car Charging Industrial Design Sketch

Ev Charging Stations 101 Wright Hennepin

Pilot Ac Charging Pile On Behance Electric Car Charger Interactive Design Industrial Design Sketch

Rebates And Tax Credits For Electric Vehicle Charging Stations

How To Choose The Right Ev Charger For You Forbes Wheels

How To Claim Your Federal Tax Credit For Home Charging Chargepoint